ICPS held a conference "Transparency, financial health and competitive municipalities: presentation of online platforms"

03.03.2017Within the project “Transrarent, financially healthy and competitive local governments in Ukraine” which is implemented by the Institute for Economic and Social Reforms in Slovakia (INEKO), in partnership with the International Centre for Policy Studies (ICPS) and with financial support of the Official assistance for development of the Slovak Republic – SlovakAid there was held a presentation of online platforms.

"The transparency of 50 largest cities in Ukraine” (http://transpare

- The responses to the questionnaire were sent by ICPS to 50 city councils. Each questionnaire contained 23 questions.

- The responses to the requests for information were sent by ICPS informally - through a third person ("secret client request"). Each request contained three questions and was intended to detect city councils` reactions to requests from citizens.

- Information is publicly available on official websites of local councils.

.png)

“Transparency of local budgets and their capital cities in Ukraine” (http://budgets.i

Whereas, the transparency, the financial stability and the formation of regional competitive advantages - all these are the basic principles for the effective functioning of local authorities in the long term. The site contains data on local governments` budgets of all 24 regions of Ukraine and their administrative centers. According to Slovak experience, the data are divided into the following types: geographical data, short description of areas, indicators of the financial stability and financial health.

.png)

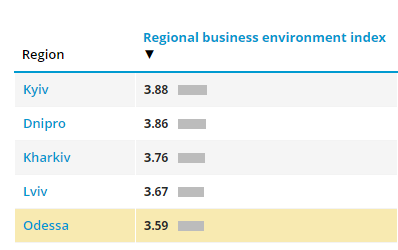

"The competitive capability of regions and measuring regional business environment in Ukraine" (http://competiti

Analysis of the competitive capability of regions should provide stakeholders the information on business environment current state in the regions, as well as the specific problems of economic development in the regions. The project will provide the local government representatives a useful tool for regional development and eliminating the local barriers of business environment. The assessment model of the competitive capability of regions in Ukraine covers 24 regions of Ukraine (all areas excluding the Crimea). Regional Business Environment Index (RIDS) is calculated on the basis of 103 independent indicators that are calculated on the basis of two sources of information: statistical data for 2014-2015 and companies` survey concerning assessment of business conditions in the regions.

Project partners Robert Kičina (Business Alliance of Slovakia), Peter Golias (Director of the Institute for Economic and Social Reforms) and Michal Piško (Project Coordinator of Transparency International Slovakia) presented the implementation experience of the project in Slovakia. National Deputy Oksana Prodan as representative of the Chairman of the Cities Association of Ukraine in the Verkhovna Rada on behalf of the community noted about the local governments` transparency factor as an important prerequisite for creating a favorable business environment and investment climate in general. Advisor to the Mayor of the Dnipro city, Yanika Merylo in her speech focused about the necessity to introduce online services that will allow every citizen to keep track of their city, from the procurement to the infrastructure facilities map.

Presentations:

Guarding financial health of local governments in Slovakia

How to improve the transparency level in municipalities

MEASURING REGIONAL BUSINESS ENVIRONMENT IN UKRAINE

ПРОЗОРІСТЬ 50 НАЙБІЛЬШИХ МІСТ УКРАЇНИ. Вероніка Харук

Конкурентоспроможність регіонів та регіональна оцінка ділового клімату в Україні. Василь Поворозник

Прозорість бюджетів регіонів та їхніх регіональних центрів в Україні. Ангела Бочі

ICPS presented the Financial Health Rating of Ukrainian Banks

On Wednesday, March 11, at the Ukrinform IA experts presented the Financial Health Rating of Ukrainian Banks, created by the International Centre for Policy Studies (ICPS) with the support of experts of the Independent Association of Ukrainian Banks. ICPS economic analyst Yegor Kiyan stressed that the Rating presented was created based on 2019 results and is calculated as the sum of the sub-indices of reliability and efficiency. "The first subindex summarizes a group of criteria that assess the extent to which a bank has complied with key economic standards, thus reflecting its ability to withstand internal and external risks to its operations," said Yegor Kiyan. - The second subindex reflects the criteria that evaluate a bank's ability to generate profit and the efficiency of its assets. As a result, the bank is evaluated in terms of attractiveness for both its shareholders and its customers.” The rating of the financial health of Ukrainian banks with assets over UAH 50 billion was led by PrivatBank JSC, the second place was taken by Ukrsibbank JSC and the third place by Raiffeisen Bank Aval JSC. Financial health rating of banks with assets over UAH 50 billion: Place Bank Assets, thousand UAH Standards Index Place Efficiency Index Place Overall index 1 JSC KB "PRIVATBANK" 552 058 120,2 1,49 3 2,48 1 3,97 2 JSC "UKRSIBBANK" 56 023 116,5 1,66 2 1,86 2 3,53 3 Raiffeisen Bank Aval JSC 95 158 659,8 1,45 4 1,78 3 3,23 4 JSC "Ukreximbank" 202 921 853,0 1,68 1 1,31 6 2,99 5 JSC PUMB 63 160 034,7 1,25 6 1,56 4 2,81 6 JSC "ALFA-BANK" 87 586 005,5 1,36 5 1,45 5 2,81 7 JSC "UKRGASBANK" 127 563 582,9 1,17 8 1,01 7 2,18 8 Oschadbank JSC 314 295 589,0 1,25 7 0,04 8 1,29 The rating of financial health of Ukrainian banks with assets over UAH 2 billion was led by Idea Bank JSC, second place by SITIBANK JSC, third by A-Bank JSC. Rating of banks with assets over UAH 2 billion: Place Bank Assets, thousand UAH Standards Index Place Efficiency Index Place Overall index 1 Idea Bank JSC 7 879 807,4 1,88 4 4,48 1 6,36 2 SITIBANK JSC 31 457 058,2 1,95 2 3,21 3 5,16 3 JSC "A - BANK" 8 219 234,2 1,34 27 3,28 2 4,62 4 JSC KB "PRIVATBANK" 552 058 120,2 1,49 17 2,48 4 3,97 5 UNIVERSAL BANK JSC 20 103 054,0 1,42 21 2,22 5 3,65 6 JSC "UKRSIBBANK" 56 023 116,5 1,66 10 1,86 6 3,53 7 Raiffeisen Bank Aval JSC 95 158 659,8 1,45 20 1,78 7 3,23 8 BANK CREDIT DNIPRO JSC 11 394 975,3 1,47 18 1,72 9 3,19 9 OTP BANK JSC 49 297 258,1 1,39 23 1,77 8 3,17 10 JSC "Ukreximbank" 202 921 853,0 1,68 9 1,31 13 2,99 11 CREDIT AGRICOLE BANK JSC 37 243 986,7 1,37 24 1,59 10 2,96 12 ING Bank Ukraine JSC 13 838 802,2 1,92 3 0,91 22 2,83 13 JSC PUMB 63 160 034,7 1,25 30 1,56 11 2,81 14 JSC "ALFA-BANK" 87 586 005,5 1,36 25 1,45 12 2,81 15 JSC BANK FORWARD 2 980 905,3 1,52 15 1,29 14 2,81 16 AB "RADABANK" JSC 2 098 830,5 1,81 7 0,87 24 2,67 17 JSC "IIB" 3 775 683,0 1,73 8 0,87 23 2,60 18 PROCREDIT BANK JSC 24 321 817,1 1,59 13 0,99 20 2,58 19 Poltava-Bank JSC 2 633 544,8 1,66 11 0,83 27 2,49 20 Deutsche Bank DBU JSC 2 748 887,5 1,88 5 0,60 30 2,48 21 JSC "KB" GLOBUS " 4 121 863,8 1,24 32 1,23 15 2,47 22 CB "AKORDBANK" 3 075 423,5 1,47 19 0,93 21 2,39 23 Piraeus Bank ICB JSC 3 052 804,3 2,02 1 0,35 34 2,37 24 JSCB "CONCORD" 2 092 995,5 1,23 33 1,14 17 2,37 25 JSC "CREDOBANK" 19 867 892,6 1,17 35 1,15 16 2,32 26 JSC "UKRGASBANK" 127 563 582, 1,17 36 1,01 19 2,18 27 TASCOMBANK JSC 19 977 706,3 1,31 28 0,86 25 2,16 28 BANK ALLIANCE JSC 3 608 932,3 0,98 38 1,13 18 2,11 29 PJSC "BANK EAST" 11 049 720,2 1,18 34 0,85 26 2,03 30 MTB BANK PJSC 5 662 695,2 1,35 26 0,60 29 1,95 31 JSC "Southern" 28 195 214,2 1,30 29 0,64 28 1,94 32 JSC "CLEANING HOUSE" 2 868 925,0 1,50 16 0,41 32 1,90 33 PRAVEX BANK JSC 5 804 986,5 1,86 6 -0,08 40 1,79 34 JSCB INDUSTRIALBANK 4 237 166,7 1,63 12 0,15 36 1,78 35 JSCB Lviv 3 231 086,7 1,41 22 0,36 33 1,76 36 JSCB "ARCADA" JSC 2 110 041,9 1,55 14 0,01 39 1,56 37 JSC BANK SICH 2 114 917,0 1,10 37 0,46 31 1,56 38 Oschadbank JSC 314 295 589,0 1,25 31 0,04 38 1,29 39 BANK INVEST. AND SAVINGS 4 249 225,5 0,62 39 0,32 35 0,94 40 MEGABANK JSC, Kharkiv 10 059 191,9 0,47 40 0,07 37 0,54 In general, according to Yegor Kyan, 2019 was a very successful year for the banking system. “This is confirmed by the fact that no bank was declared insolvent during the previous year. In addition, strong hryvnia and high interest rates have guaranteed high returns for the banking sector." Olena Korobkova, Executive Director of the Independent Association of Banks of Ukraine, stressed the risk factors of Ukraine's financial system in 2020. “If you look at the chain of recent events: the spread of the coronavirus, the sale of assets, the rapid fall in oil prices - all this is a significant cost to the world economy and all this can lead to a weakening of demand for Ukrainian exports, and consequently lower quotations of important positions for Ukraine: steel, halls ore, agro products, ”she emphasized. - And in the aggregate it will be reflected in our banking system. If the rate deviates by 10-15%, almost every bank will need additional capital. "

TOP-50: ICPS presents the rating of the most successful state enterprises of Ukraine

On Thursday, June 13, the International Center for Policy Studies presents a rating of financial stability of state enterprises of Ukraine and launched an Internet portal under the same name with detailed indicators of each successful state company. In the rating presentation at “Ukrinform” ICPS expect Yehor Kyian said that 50 of the largest companies were selected on their total value of assets. Financial stability was marked against four criteria: liquidity, rentability, leverage and financial operations. UKSATSE led the rating of the state enterprises with their overall financial sustainability receiving a rating of 8 out of 10. The companies that followed in the rating were: Mariupol Sea Commercial Port, State Enterprise “Administration of Sea Ports of Ukraine” and the State Enterprise “Lviv International Airport”. The lowest financial stability was demonstrated by PJSC "Port Plant" and NSC "Olimpiyskiy". ICPS analysts noted that ten of the top 50 state-owned companies were not transparent enough to keep their accounts in check, which hindered their stability, so all of these businesses were assigned 40th place. ICPS expert Yehor Kyian also emphasized that the best financial indicators were demonstrated by transport and logistics state enterprises. He also highlighted that the results can be accessed on an interactive portal with the individual results, available at the link: http://companies.icps.com.ua. Those participating in the project are dedicated to update the indicators as state companies submit their financial statements. The project “Financial stability of state enterprises in Ukraine” is aimed at improving the efficiency of management as well as implementing of the “Promoting Transparency and Implementation of Anti-Corruption Measures in State Enterprises and Local Self-Government Bodies in Ukraine” framework. It is being carried out by ICPS in partnership with the Institute For Economic and Social Reforms (INEKO) and Official Support for the Development of the Slovak Republic (SlovakAid).

Rating of financial health of Ukrainian banks

International Centre for Policy Studies (ICPS) and online media “Apostrophe” presented the rating of financial health of Ukrainian banks, which is planned to be updated on a quarterly basis. The presentation took place on March, 12 in Kyiv. The uniqueness of the rating is that banks were evaluated in terms of attractiveness for both their own shareholders and their clients. It characterizes the bank's business model as a whole and is calculated as the sum of sub-indices of reliability and efficiency. “The first sub-index summarizes a group of criteria that assess the degree to which the bank complies with key economic standards, thus reflecting its ability to withstand internal and external risks for its operations. The second sub-index reflects the criteria for assessing the bank's ability to generate profits and the efficiency of its assets,” senior ICPS expert Yehor Kyian said. The rating was elaborated separately among large banks (with assets over 50 billion USD) and all banks with assets of over 2 billion USD. “At the moment, the most financially healthy among large banks is PrivatBank, Alfa-Bank and Raiffeisen Bank Aval. These banks are trying to adhere to all standards and fulfill all their obligations,” Yehor Kyian said. Under the sub-index of reliability among large banks, the first three banks included such as PrivatBank, Ukreximbank and Raiffeisen Bank Aval. In turn, Alfa-Bank, Raiffeisen Bank Aval and PrivatBank are the leaders in the sub-index of efficiency. Top 10 banks with assets in excess of 2 billion UAH include Idea Bank, Universal Bank, A-Bank, Citibank, PrivatBank, Alfa-Bank, Raiffeisen Bank Aval, MIB, Credit Agricole Bank, OTP Bank. The results of the rating showed that small banks compete successfully in compliance with the standards, and large banks often show significant efficiency in using their assets. There is also a significant gap between the most and the least financially healthy banks (almost in six times), indicating a significant margin for improvement. Executive Director of the Independent Association of Ukrainian Banks Olena Korobkova is convinced that the situation in the banking sector after the “banks fall” in 2014-2015 years is gradually being adjusted. “As of January 2019, we have 67 profitable banks. Over the past year, we have only one bank left, it's “VTB Bank”. The redistribution of customers has already taken place, so the banking system has already been updated and I hope that it will gain momentum in the growth of the Ukrainian economy,” she said. At the same time, Olena Korobkova noted: “Any rating is an additional sign for making a decision in which bank to serve. According to world experience, many factors are needed to be considered and ranking is one such”. The chairman of the International Centre for Policy Studies Supervisory Board Viktor Mashtabey advised researchers who promise to update the rating quarterly, to try to expand it comparing to the situation in other countries. The rating of financial health of Ukrainian banks and more detailed information on research and methodology can be found via the link (Ukrainian version): LINK

Peculiarities of IMF Memorandum Implementation in 2019

Ukraine received the first part of the IMF tranche in the amount of 1.4 bln. dollars on December 25, 2018. Accordingly, there will be a need to struggle for additional 2.5 bln. dollars. Of course, the Stand by requirements of co-operation are softer than under EFF, and the risks of non-obtaining the next part are lower, however the necessity of receiving the money "pressures" the government so that the interested stakeholders can take advantage of it and push their whims, especially before the elections, under cover of the necessity to meet the requirements of the memorandum. Therefore, it is necessary to analyze the possible areas for manipulation. The International Monetary Fund approved a program of assistance for Ukraine in the amount of 3.9 bln. dollars under the Stand by program on December 18, 2018. There are less requirements under this program. However, the interesting fact is that the review of the program and, accordingly, the progress of the implementation of the memorandum will only be in June-July, just after the presidential elections. On this basis, two risks can be noticed at once - attempts to reach the elections at any price and the uncertainty about the policy of the future president. With regard to monetary policy, taking into account the effectiveness of the NBU, no one should worry about it. According to forecasts, inflation in 2019 should be at the level of 7% - in case, of course, the coordination between the authorities will not fail. In turn, the introduction of medium-term budget planning will be introduced at least declaratively and will enable the effective implementation of budget projects for more than 1 year. In turn, political bargaining can lead to the situation when the requirements, that have a significant impact on the Ukrainian economy, will appear the most difficult to implement, in particular, the adoption of laws on SPLIT, privatization, energetics, administration of revenues and monetization of subsidies. What does the IMF require? · Administration of revenues The memorandum requires the reorganization of the State Fiscal Service (SFS) into two legal entities: the State Tax Service (which will include the department of the tax police) and the State Customs Service. They will be under accountability of the Ministry of Finance. This structural benchmarks must be completed by the end of April 2019. It is also planned to replace the Tax Police with a new institutional body. The first problem is that the unification of central and regional SFS offices takes place during the budget decentralization process. The latter gives local authorities the opportunity to set the rates and to administrate the taxes. At the same time, the reorganization of the SFS does not provide for the possibility of administrating the local taxes and fees directly to local authorities. Another problem is that the reorganization of the SFS does not solve the systemic problems. In particular, Ukrainian customs is currently under the jurisdiction of the SFS. The losses from smuggling and from the "inefficiency" of its functioning are over 4-5 billion dollars annually. The same figures were mentioned by the Minister of Internal Affairs of Ukraine Arsen Avakov, during the meeting with the representatives of business regarding the fight of law enforcement agencies against smuggling at the customs. Such sums are impressive due to these funds could be used to address the key economic and social issues of the Ukrainian economy. · Energetics Despite the positive developments and understanding of the need to preserve the Ukrainian gas transportation system, which resulted in a twofold decrease of gas transit tariffs, the government, while preserving the monopoly in the energy market, pushed the requirement for further tariff increase for gas and heating. In addition, an increase in gas extraction is required. The situation will be more complicated with regard to carrying out the unbundling of NJSC "Naftogaz of Ukraine". According to the agreements, it should transfer non-core transit activities to PJSC "Main Gas Pipelines of Ukraine" in 2019. In addition, the certification of the operator of the gas transportation system should take place. Firstly, the government and the management of "Naftogaz" have different views on the unbundling process (Full Ownership Unbundling or Independent System Operator), which may delay its practical implementation. Secondly, after tripartite consultations with the EU and "Gazprom", NJSC "Naftogaz of Ukraine" declared the impossibility of carrying out the unbundling due to gas contract with the Russian Federation. Under current contract, the functions can be divided only after the consent of the RF. There is also resistance from the side of "Naftogaz" - after the distribution of functions, it will only have the role of a trader. Thus, unbundling is unlikely to happen until the end of 2019. · Monetization of subsidies The pilot project should start in March 2019. Currently, there are 4 million recipients of subsidies in Ukraine and its average size is 1500 UAH. Thus, the government will give nearly 6 billion UAH per month in cash. At the same time, although the monetization of subsidies is to some extent a promising solution, however under the monopolization of the utility market, the recipient of subsidies will still not be able to select to whom, how and how much to pay - the money will be received by the same companies. In addition, it should be taken into consideration that presidential elections will take place in April and the monetization of subsidies during this period can easily "bribe" the voter. · Financial policy The memorandum includes the requirement of further increase in the stability of the banking system, the growth of the capitalization of banks (by the end of March 2019), a decrease in the amount of non-working loans, the entry of EBRD and IFC into the capital Oschadbank and Ukrgasbank. An important requirement is the adoption of the Law on amendments to certain legislative acts of Ukraine regarding the consolidation of the functions of state regulation of financial services markets or, in other words, the Law on "Split" (by the end of March 2019, a structural benchmark). As a result, all functions of the National Financial Services Commission are transferred to the NBU, except that are not related to pension funds, construction financing funds and real estate financing funds - the latter will be transferred to the National Securities and Stock Market Commission. In turn, the National Financial Services Commission will be liquidated. While analyzing the market of non-bank financial institutions, statistics show that there were 2021 of them as of December 2018. Such a number of institutions indicates the demand and importance of non-bank financial institutions for the functioning of the market. Non-bank financial institutions in Ukraine Type of institution Amount, as of December 2018 Assets, thousand UAH Administrator of non-state pension funds 22 With NBU – 1 027 260 286 Without NBU – 259 286 Trust company 2 - Credit union 358 2 169 796 Pawnshop 366 3 763 667 Non-state pension fund 62 2 465 560 Insurance company 281 53 679 752 Financial company 930 66 780 189 Source: according to the National Financial Services Commission The relevant existing parameters and norms for their functioning will be later changed by the regulator, probably after the adoption of the Law on SPLIT. Thus, there may be a conflict of interests due to higher requirements and "own" standards. Such implementation of the new standards may suspend the development of non-bank financial institutions and may cause the companies exit from the market. On the other hand, this situation can stimulate the development of banking institutions, while opening the new niches for them. · Privatization According to the agreements, nearly 500 objects of small-scale privatization should be sold through the system of electronic auctions ProZorro by the end of April 2019. Regarding large privatization, 16 objects will be offered for sale: - Energy industry: PJSC "Tsentrenergo" (should be sold in the first half of 2019); OJSC "Ternopiloblenergo"; PJSC "Zaporizhiaoblenergo"; JSC "Kharkivoblenergo"; JSC "Mykolaivoblenergo"; JSC "Khmelnytskoblenergo". - Mining industry: JSC "United Mining and Chemical Company"; State Enterprise "Coal Company "Krasnolymanska" (should be sold in the first half of 2019). - Machine and instrument making: PJSC "Azovmash"; SE "Plant "Electrotyazhmash". - Chemical industry: PJSC "Sumykhimprom"; PJSC "Odessa Port Plant". - Processing industry: JSC "Oriana". - Health, culture and sports: PJSC "President-Hotel" (should be sold in the first half of 2019); PJSC "Indar" (should be sold in the first half of 2019). - Agriculture: PJSC "National Joint-Stock Company "Ukragroleasing". It is important to mention that Ukraine pledged to submit a draft law on reducing the list of companies prohibited for privatization (by the end of April 2019). Taking into account the statements of the Head of the State Property Fund regarding the IMF support in privatization (however, it cannot be said that the IMF itself will be involved in the re-activation of large privatization), there is a risk that this process may turn into a "strategic flea market" for stakeholders, seemingly under the cover of direct IMF requirements. There may also be some issues with regard to state property leasing laws and concessions that are to be adopted in the first half of 2019. In particular, behind the good intentions of finding additional funding, there may hide the "monopolization" of key state property in order to enrich people close to local authorities. There may be a situation when the property, that is built on budget funds and cheaply placed for concession, will be exploited just before the next need for restoration or repair. In this period, it may simply be returned to the state. In addition, the state's interest in maintaining its own facilities in good condition under the "concessionary agiotage" is lower, taking into account the lack of funds for regional programs and needs. What will not happen? The IMF memorandum mentions reforms that will not be carried out in 2019. In particular, there will not be tax amnesty, tax benefits or privileges will not be introduced. There is also no provision for the introduction of a tax on withdrawn capital and a second level of the pension system. However, there also will not be a significant economic development of Ukraine in 2019. In particular, the World Bank has worsened the forecast of GDP growth for Ukraine to 2.9% in 2019. The forecast was also revised downwards by the Ministry of Finance - according to it, growth will be only 3%. For the effective cooperation, the Ukrainian economy should grow at least 5% of GDP per year. And for this purpose it is necessary to solve a number of systemic problems: - Growth indicators. The peak of GDP growth in Ukraine is already passing. The effect of the zero base played in favor of the government before, however currently achieving growth is becoming impossible without real changes and reforms. Forced tightening of screws, strict monetary policy with corresponding interest rates restrain the country's economic development, resulting not in an inflow, but in an outflow of capital. - Trade indicators. Trade imbalances, the prevalence of raw materials in Ukrainian exports, import and energy dependence only worsen the trade balance indicators with each year and reduce the foreign currency earnings. - Indicators of transparency and corruption. Launching the work of the Anti-corruption court, increasing the efficiency and transparency of the authorities will promote the fair distribution of funds and improve the investment climate. - Indicators of reforms (market). The reforms in the country should be carried out independently, without the need for external supervision and control. Unfortunately, the IMF is the only lever of influence on reforms in the country. At the same time, the IMF acts as a kind of "reanimation brigade". The problem is that reanimation of the country for 25 years (the Ukraine-IMF relationships continue for such a period) already seems to be wrong. Currently Ukraine has almost reached the amount of 30 billion dollars of loans from the IMF throughout the history of relations and for another 15 years Ukraine will have to pay all its debts. As long as there is a propagation of the ideas of interested stakeholders, without taking into account the national ones, under the cover of the IMF requirements with its corresponding "demonization", instead of real and full reforms, economic development should not be expected; and it is unlikely that Ukraine can become a success-case in IMF portfolio.

Economic Outcomes and Prospects of Ukraine: Progress, Regress or Status Quo?

On the one hand, the year 2018 is characterized by relative stability of the economic situation in the country, and, on another hand, is showing the lack of achievements. At the same time, foreign economic situation in 2019 may worsen, while leading to greater stagnation or even economic crisis. In turn, Ukraine is still completely unprepared for the year 2019 because of the government's failure or reluctance to show political will to implement the reforms. Accordingly, Ukraine should learn how to minimize the economic risks of probable occurrences, not just their consequences post factum. What was remarkable in 2018? Compared to previous years, the economy of Ukraine developed in the absence of significant shocks in 2018. The main changes that have had a greater or lesser impact on economic development were the following: • Macroeconomics and finance. The fact that for the first time since the crisis the banking sector has become and remains profitable can be stated among the achievements in this area. Also, tax revenues have raised. On the other hand, this growth was more due to inflationary processes in the country and due to the increase of wages. This has affected the expansion of the tax base and, accordingly, the tax revenues. At the end of 2018, a balanced budget was adopted. On the other hand, the slow pace of economic growth and insufficient growth of domestic production were felt, inflationary pressures increased remarkably. Accordingly, the discount rate was raised, which currently amounts up to 18% per annum, thus restraining the economic development. Further stability of the economy is unlikely to be able to "be guided" only by the discount rate and currency intervention. A three-year budget planning for minimizing the shocks has not been launched. In addition, the following was observed in the economy: - insufficient amount of investments, problems with timely allocation of money of financial organizations and other funds for infrastructure projects; - the share of non-performing loans in the Ukrainian economy reached 54.31% (as of October 2018); - there were problems with reimbursement of benefits and subsidies for the enterprises of housing and communal services, etc. • International economic relations. It looked like that only the NBU fought with the results of non-market price increases, turbulence in foreign markets and the decrease of investors' interests in Ukraine in 2018. Meanwhile, there was a relative stability of hryvnia, the dynamics of replenishment of gold and foreign exchange reserves was positive during the year. At the same time, asymmetries in foreign trade and insufficient lobbying of national interests was present. In particular, this led to the fact that Ukraine used quotas for the main commodity groups in trade with the EU during the first months of 2018. According to the latest State Statistics Service data, the negative foreign trade balance of Ukraine is $ 3.45 billion after 3 quarters of 2018 passed. For comparison, during the same period of 2017, the negative foreign trade balance was equal to $ 1.11 billion. In addition, the following facts should also be noted: - emigration remains one of the main problems of Ukraine in recent times; - the entering to the foreign borrowing market in 2018 was not urgent; the strategy on external and internal debt remains declarative; - Ukraine could not agree with the IMF on the tranche during the year. There is still a small chance to get a tranche for the New Year's holidays. • "Non-market Shocks". Among the "non-market shocks" in 2018, the following is particularly highlighted: - Situation in the waters of the Azov Sea and the problems with the passage of ships to Ukrainian ports. Despite the fact that the total turnover of Azov ports is barely up to 4 million tons, the delays in the delivery of cargoes in this region have created threats to the functioning of local infrastructure and worsened the transit status of Ukraine. - The introduction of the martial law has become a precedent for Ukraine and economy. Although it will not significantly affect the state of the economy in 2018, however, it has given negative signals to investors regarding the development of the situation in the country. • Energetics. Form the positive side, it is worth mentioning the encouragement of the increase of the green energy share. On the other hand, currently, the share of renewable energy in Ukraine is only 1.8% (in price - 8.3%). In addition, the Stockholm Arbitration Court ordered Gazprom to pay the Ukrainian company $ 4.63 billion for short supply of gas under transit contract (or $ 2.56 billion, taking into account the Ukrainian side's debt for the supplied gas). There were no other achievements in the energy sector. All the same problems remain with the "creation" of formula tariffs, subsidies and payments between the major suppliers in Ukraine (due to which problems in receiving hot water and heating occurred in a number of cities), the general constant increase of tariffs for households and industrial producers, overloading of power stations, etc. In addition, the unreasonable government policy, insufficient gas volumes in the storage facilities during early March led to its deficit in the country (which was the reason for the declaration of an emergency situation), and which was solved by additional, more expensive imported gas. • Privatization. There was a failure of privatization again because of poor management of state property and the inability to trade: the sale of state property brought less revenues to the state budget than was planned. The reason was the disruptions / failures of large privatization objects sale due to their unsatisfactory conditions, including finance, and peculiarities of participation in tenders, the politicization of some decisions. The inability to sell the companies resulted in the decrease of their attractiveness, while reducing their estimated value and possible revenues to the budget. As a result, large privatization has been postponed for 2019. • Improved transparency. Under this aspect, in particular, the transparency of the banking system has partially increased due to the new requirements for the organization of risk management system, due to the disclosure of data on components and capital adequacy of banks, and due to the creation of a credit register. As for other spheres of economy, an online resource for price tracking was launched, new sections were introduced on e-data regarding the openness of local budgets data, there was some degree of de-shadowing and improvement of tax servicing, small privatization on ProZorro.Sales and pilot projects on the introduction of electronic receipt (e-Receipt) were launched. Nevertheless, the openness of data is unlikely to effectively impact the minimization of corruption in the country at this stage. What does await Ukraine in 2019? The following year, Ukraine will need to concentrate on the following areas: • Macroeconomic indicators. Among the main ones it is necessary to highlight: - Growth of GDP in 2019 will slow down to 2.3% due to lower growth rates of the global economy and due to allocation of significant amount of money on debt financing. - In the beginning of the year, the inflation will significantly accelerate due to rising gas prices for the population and corresponding revision of tariffs for heating and hot water. In general, inflation will decrease to 6.8%, primarily as a result of tight monetary policy in 2019. - The election campaign can lead to an increase in social standards while lacking the sufficient economic growth. KEY INDICATORS Final data Estimate Forecast Year 2014 2015 2016 2017 2018 2019 2020 NATIONAL ACCOUNTS GDP, billions UAH 1 567 1 979 2 385 2 983 3 483 3 918 4 348 Real GDP, apc** -6,6 -9,8 2,4 2,5 3,0 2,3 2,6 Real total consumption, apc -6,2 -15,2 2,0 7,1 3,5 2,1 2,1 Real gross fixed investment, apc -24,0 -9,2 20,4 18,2 14,0 8,0 8,0 MANUFACTURING AND AGRICULTURE Real industrial output, apc -10,1 -13,0 2,8 0,4 1,7 2,2 2,4 Real agricultural output, apc 2,2 -4,8 6,3 -2,7 8,0 0,0 3,0 HOUSEHOLDS Population at the start of the year, millions 45,5 45,3 45,2 45,1 44,9 44,8 44,7 Real disposable household income, apc -11,5 -20,4 2,0 7,4 8,0 2,0 2,0 Average monthly real wages, apc -6,5 -20,2 9,0 19,1 13,0 5,0 5,0 Average monthly nominal wages, UAH 3 480 4 195 5 183 7 104 8 912 10 371 11 898 Unemployment rate, ILO methodology, % 9,3 9,1 9,3 9,5 9,0 8,5 8,0 Real retail trade, apc -9,6 -19,8 4,5 6,0 4,0 3,5 3,0 PRICES Consumer price index, apc 24,9 43,3 12,4 13,7 10,0 6,8 6,0 Producer price index, apc 31,7 25,5 35,7 16,5 16,0 10,0 9,0 Construction price index, apc 15,7 22,7 9,9 15,5 22,0 8,0 8,0 FOREIGN ECONOMIC ACTIVITY Exports of goods and services, apc -19,9 -26,9 -3,9 17,1 10,0 4,5 4,3 Imports of goods and services, apc -28,1 -29,3 4,5 19,2 14,5 2,8 3,4 Current account balance, % GDP -3,5 1,8 -1,4 -2,2 -4,3 -3,8 -3,5 Net FDI, millions USD 299 3 012 3 268 2 593 2 300 2 500 2 500 FINANCIAL INDICATORS Monetary base, apc 8,5 0,8 13,6 4,6 6,0 5,0 4,0 М3, apc 4,9 3,9 10,8 9,5 8,0 7,0 6,0 NBU gold/forex reserves, millions USD 7 533 13 300 15 539 18 808 19 000 18 000 17 000 Official exchange rate, average annual, UAH/USD 11,89 21,84 25,55 26,60 27,30 29,50 31,00 UAH loan interest, last month of the year, % 16,6 20,4 15,2 17,5 22,0 20,0 18,0 Source: "Economic Analysis and Current Trends: Forecast for 2018-2020", ICPS, 2018 • Energy aspect. In general, the issue of the strategy for achieving the energy security remains one of the most important challenges for Ukraine's national interests. The Ukrainian government has announced the plans to achieve the country's energy independence and sustainable development, however the path remains blurred. Realization of Russian projects of alternative gas pipelines may leave Ukraine on the sideways of such an important element of economic activity as transit of gas, while leading to significant financial losses. In particular, a contract between Gazprom and Naftogaz for the transit of gas ends on December 31, 2019. At the same time, Gazprom filed a lawsuit regarding the termination of the transit contract through Ukraine. The arbitration institute of the Chamber of Commerce of Stockholm united the above-mentioned lawsuit with the Naftogaz's claim to revise the tariff by $ 12 billion in one case. • International finance. Due to trade wars and capital outflows from developing countries, Ukraine may have lower foreign currency earnings. In addition, the loan market will become more expensive. Partially, the new tranche of the IMF may help Ukraine, however, given that the next year Ukraine needs to pay $ 5.88 billion of external debt and $ 14.8 billion of internal debt, while the gold and foreign exchange reserves are projected to be at the same level, its volumes will be not enough to solve all the problems of Ukrainian economy. The government will need to search for the ways to get out of the situation. In the absence of the state's strategy of managing the external and internal debt, the country will face additional challenges for development. In addition, there was no final decision of the London High Court on "Yanukovych's debt", amounting up to $ 3 billion. Theoretically it can be adopted in 2019. Main scenarios and recommendations Thus, the Ukrainian economy did not achieve significant results in 2018 and remains vulnerable to external shocks of the following years. There is an urgent need to minimize the listed risks to economic development of the country. On the background of less optimistic governmental predictions regarding the year 2019, the problem of a vicious circle "maintaining stability - the lack of economic prospects" becomes apparent, and the issues how to escape out of it and what to do next rise. In this regard, the introduction of effective medium-term planning could theoretically add "predictability" to the development of the Ukrainian economy. On the other hand, applying of such an approach practically in the realities of Ukraine is quite complicated while its vulnerability to internal and external shocks. Accordingly, any plans can be easily "spoiled" under turbulence conditions. In addition, the biggest part of the indicators of Ukrainian plans are set manually, while depending on the "mood" of the government, and are usually static rather than dynamic. They do not change automatically, while based on the formula calculations depending on the situation, and they do not guarantee the promptness of updating the plans or their relevance and independence from the government decisions. The final result is blurred. Thus, it is important how the "reboot" of the government after the elections in the next year will take place. Taking into account the above stated, it is necessary to maintain stability in the mid-election period. In general, the positive scenario of the Ukrainian economy's development in 2019 is unlikely to happen and is not feasible for consideration. Therefore, there is a need to distinguish the following scenarios: • The basic scenario seems to be more credible. According to it, the transitional government will not risk making significant changes and implementing reforms. The Ukrainian economy will continue its stagnant development trend. On the other hand, this will not cause any resistance from the interested stakeholders and the government will be able to fulfill its functions. • In the case of a negative scenario, the post-election period will be characterized by blocked decisions of the transitional government, uncertainty and lack of time for maneuver. Ukraine risks not getting a tranche of the IMF and will not be able to pay off its debts. This will result in the country's technical default. Accordingly, while "rebooting" period, making changes will be inappropriate and difficult. However, after the formation of the government, it will be important to rethink economic development, because otherwise Ukraine will change the stagnant trend. Nevertheless, Ukraine gains experience with every year and 2019 may be extremely fruitful.

Macroeconomic Indicators for Autumn 2018 - ICPS Forecast

The International Center for Policy Studies (ICPS) has prepared another analytical publication “Economic analysis and current trends” for September 2018. It contains a detailed analysis of indicators of the manufacturing sector, prices, financial markets and the forecast for 2018-2020 for the development of the Ukrainian economy. According to the analytical document, the beginning of the autumn 2018 was characterized by the following facts: - the harvest of early cereals decreased significantly compared to the previous year due to the lower level of yield; - the yield of late crops has grown substantially, so that the yield of corn and sunflower should be much higher than in the previous year; - at the beginning of autumn, industrial production declined by 0.5% y/y; - estimate of GDP growth in the second quarter of 2018 increased to 3.8% y/y; In turn, in the forecast part it is stated that: the forecast for economic growth in 2018 remains at 3%; in case of non-receipt of IMF financing, growth rates may be lower; in the baseline scenario, GDP will increase by 2.5% in 2019; The material is available in Ukrainian as well as in English. Contact ICPS for more information, ordering, previewing the release, and getting acquainted with the terms of subscription: e-mail: [email protected] тел. (044) 253-22-29, (068) 831-94-69